Trusted nonprofit debt relief is here for you. Whatever your situation, we’ll work with you to get relief from the financial stress you’re living with. Then, we’ll set you on a path to improving your credit and debt management skills so you can live a financially fit life.

If being a homeowner is your goal, we’ve got the program for you! The NFCC Envisioning Homeownership program was created to help you achieve your dream of successful, stress-free, long-term homeownership.

Trusted nonprofit debt relief is here for you. Whatever your situation, we’ll work with you to get relief from the financial stress you’re living with. Then, we’ll set you on a path to improving your credit and debt management skills so you can live a financially fit life.

A Debt Management Plan is the smart choice for paying off your debt!

- Nonprofit

- Can help improve credit score

- Lowers interest rates

- Helps you pay everything you owe

- One monthly payment

- Comprehensive counseling and education provided

- Provides a structured payment plan

Why Are We The Best?

Our Mission is to help our customers move passed past mistakes and clerical errors that are holding them back from achieving their dreams.

Results

How it works

Who we help

People with Debt

First-Time Home Buyers

Student Loan borrowers

Military & Veterans

Small business Owners

Get out of debt with our help!

What does financially fit mean?

You can pay bills on time

Being able to pay expenses on time, each month, avoiding penalties and minimizing interest charges.

You're building your savings

Routinely adding to your savings so there is money available for emergencies and retirement.

You're able to plan for your future

Knowing what you spend and how much you need to save, minimizing surprises, yet being ready for them, when they occur.

Which debt repayment method is right for you?

Credit Management

Credit Reports

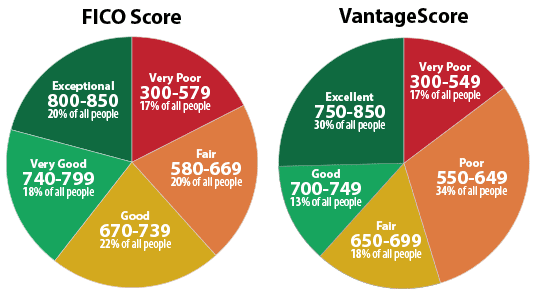

How do lenders determine who is approved for a credit card, mortgage, or car loan? Find out how to obtain your credit reports, what is in your reports, how to read them, and what they means. Learn about the different credit scores and how the scores are computed. Know who can obtain copies of your credit reports and for what purpose.

Getting out of Financial Trouble

If, like thousands, maybe even millions, of others, you are having trouble paying your debts, it is important to take action. Doing nothing can lead to much larger problems in the future, such as the loss of assets like your house, accumulating even bigger debts, and a bad credit record. Learn what you can do to turn things around and get back on track.

Divorce and Your Credit

Couples having problems usually don’t realize how their credit will be effected until after they are uncoupled, and have been left with a mess to clean up. Joint credit cards, car payments, and home mortgages are just a few of the things to consider. Divorced people usually don’t think about it until they apply for credit, a new apartment, or job, and then they realize that something isn’t right.